Real time electronic KYC verification for all China Citizen ID Cards that simplifies the customer onboarding process.

Based on a variety of authentication methods includingconsumer's identity and behavior and provides authentication services via API.

A complete Identity Verification Solution customized to fit specific business requirements.

Covers all Chinese Citizens ID Cards:

Verification of China ID Card and name

Verification of photo on China ID Card

Verification of domicile on China ID Card

Verification of China ID Card with registered phone number for all phone numbers of China Mobile,China Unicom and China Telecom

Verification of China ID Card, name, bank card number, and phone number with registered information of applicable China Bank for all credit cards and debit cards of sixteen National Banks and Regional Banks

Combined with a Tag system for basic attributes (gender,age,photo), social attributes (occupation, social, group), consumption attributes(place, product), interests and hobbies (game, book, film, travel) Converges payment authentication with KYC verification simplifying the customer onboarding process

Start accepting payments from over 800 million customers in China with an online and offline seamless payment solution.

Covers all UnionPay debit and credit cards, one of the world's leading payment card brands, and all China telecom carriers

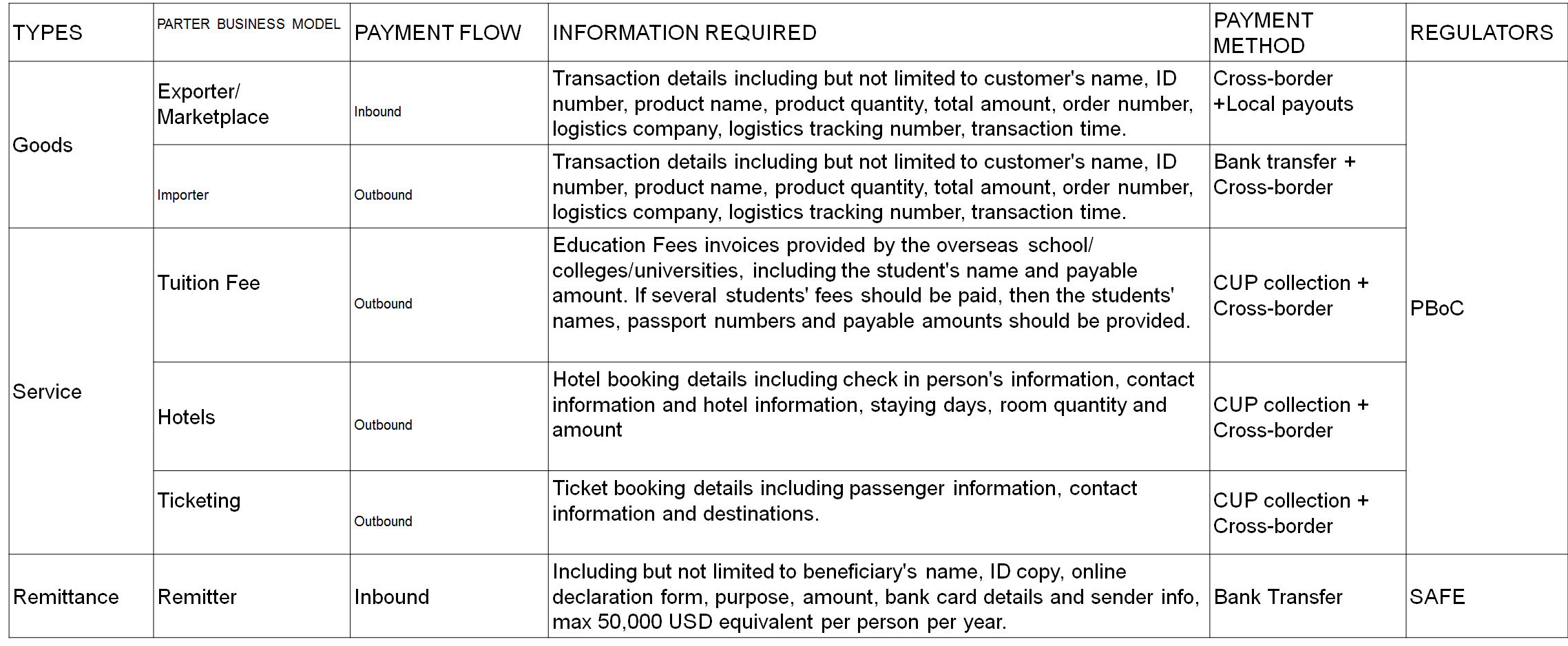

Allows merchants to send and receive payments to and from China.

China customers get to pay for their purchases with their preferred payment method and in their own currency and merchants get paid in their local currency

Provides customs compliance and clearance

Cross-border RMB outbound settlement:

Both B2B and B2C

No requirement to set up a China entity or a new bank account for domestic China collection of funds and offshore settlement

Cross-border RMB outbound settlement:

Both B2B and B2C

Payment to all onshore RMB Bank Accounts

Authentication of China Mainland Customer:

SMS Authentication

Customer provides China National Identification number, China phone number and debit or credit card number

Refunds

Processed through same chanel as initial transaction

Declines and Disputes

Simple setup via API with minimal changes to existing infrastructure:

Mobile payment

Ecommerce/online payment

Direct debit

E-payment-|(B2B payments)

In-app payment

IVR Payment- purchase made with UnionPay cardholder details and phone number through customer services by UnionPay cardholder making a call to the call centreor online with UnionPay cardholder inserting details and receiving a call back from customer service

"PayEco" Checkout- the new ecommerce platform

Transactions related to any of the following:

Drugs and related paraphernalia

Gambling and/or casinos

Direct debit

Adult content (pornography)

Capital nature

Money laundering, sham transactions and other fraudulent or deceptive actions

Any other transactions which may breach the laws and regulations of the People's Republic of China, Hong Kong SAR and the Countries and Regions involved in the transactions

Based on PBOC's policies and merchant's industry

subject to chang

Cross-border Limits

B2B: Service 1M/Goods 200K

B2C: Service 200K/Goods 200K

DNA payment limit:

RMB 20,000 per transaction, RMB 50,000 per day.

Cross-border limit: RMB 200,000 per day (Note: this means the max. cross-border limit applicable for DNA payment is actually RMB 50,000 per day).

Mobile app payment limit:

RMB 20,000 per transaction, RMB 50,000 per day.

Cross-border limit: RMB 200,000 per day (Note: this means the max. cross-border limit applicable for mobile app payment is actually RMB 50,000 per day).

Internet Payment limit:

RMB 500K - 1 mil per transaction

Cross-border limit: RMB 200,000 per day (May require multiple settlements for the same transaction over multiple days)

E-payment/debit payment limit:

RMB 500,000 per transaction, RMB 5 million per month

Cross-border limits:

1. For B2B (Outbound) & B2B (Inbound): RMB 200K per day for goods trade, RMB 1 mil for service trade

2. For Passive C2B (Outbound) & B2C (Inbound): RMB 200K per day

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.